Retirement Savings for Young Professionals in 3 Easy Steps

When you’re just getting started in your career, it’s not easy to set your sights on something as far away as retirement. Between rent, groceries, student loan payments, and the occasional happy hour with friends, your hard-earned paycheck is already spread thin.

You may be thinking: Why make things harder by worrying about something so far away? Can’t I focus on long-term savings once I’m more established with a larger income?

We understand the dilemma. Unfortunately, achieving a comfortable retirement is no longer a given. Previous generations may have relied on pensions and social security, but today’s retirees need to provide for themselves, more than ever before.

The good news: setting yourself up for a comfortable retirement is not as difficult as you think!

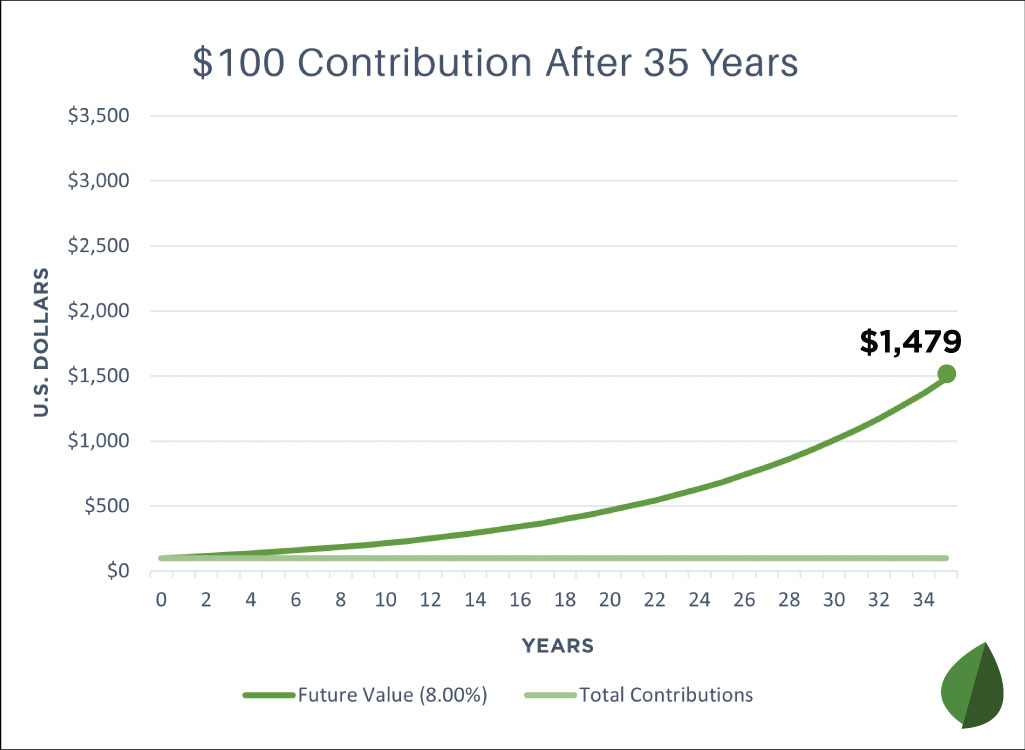

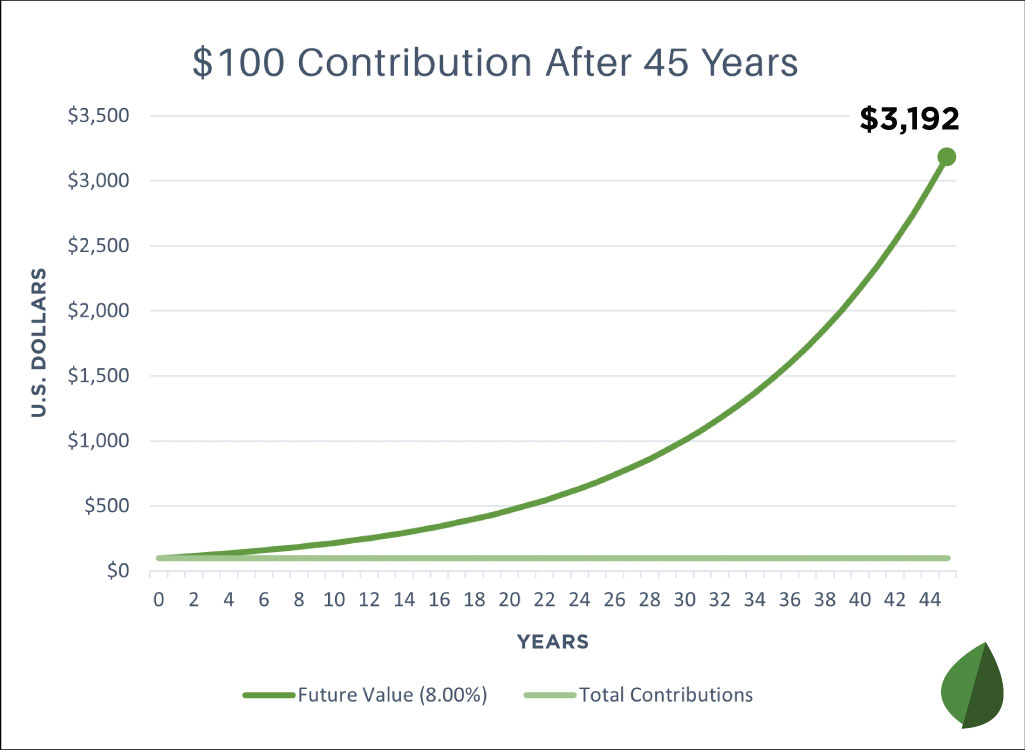

Starting early will set you up for success and help you avoid working longer than necessary or foregoing your dreams. This graph shows how one contribution of $100 will grow over time thanks to compound interest. (More on that later.) Just imagine the growth with ongoing contributions!

Ready to prepare for your golden years free of financial strain?

It comes down to three simple steps:

- Set up your account(s).

- Monitor your progress.

- Let time take care of the rest.

Step 1. Setting up a Retirement Account

There is no “one solution fits all,” but there are common accounts used to save for retirement. These are good starting places because they offer tax advantages when used correctly for long-term savings.

401(k) Accounts

Unless you are self-employed, this is likely the best place to start. A 401(k) is a company-sponsored retirement account commonly offered by employers to their employees. You often have the choice between a traditional or Roth, which differ in how they are taxed.

- Traditional 410(k) – Pre-tax contributions | Withdrawals taxed in retirement

- Roth 401(k) – After-tax contributions | Tax-free withdrawals in retirement

Your choice to contribute to a traditional or Roth (or both!) will come down to your budget and goals. A Roth can be viewed as a more favorable option because you get all of the money you’ve contributed back in retirement. However, it requires taking the tax hit up-front. If your finances are tight right now, a traditional may be a better starting place.

401(k)s have annual contribution limits, so it is important to keep those in mind when you are choosing how much to contribute from each paycheck.

Employer Match: the 401(k) secret weapon

Many employers offer a 401(k) match as part of their company benefits package. This means they will match your contribution up to a specified percentage or amount each year.

Retirement contributions that don’t come out of your own pocket? Yes please!

Example: If your employer will match “up to $500 dollars” and you maximize the benefit by contributing your own $500, the total amount that will go into your 401(k) will be $1,000 – with only half coming out of your pocket!

Be sure to take advantage of this benefit if your employer offers a match. It’s free money that can make a big difference as your balance compounds over time.

The account is yours – even if you change jobs.

Are you worried about opening a 401(k) because you don’t think you’ll stay with the same employer for long?

Rest assured, all the money you contribute to your 401(k) is yours to keep. When you leave the company, you will be provided options for what to do with your funds. You can often keep them in the same place, roll to your new employer’s plan, or roll into another long-term savings vehicle.

It’s possible, however, you may only be eligible for a portion of the funds your employer contributed through a match. Ask about the vesting schedule to understand if the match funds are subject to a specified length of employment.

DO THIS:

- Contact your company’s human resources department to learn more about your employer’s 401(k) options.

- After opening an account, review the annual contribution limits and your budget to determine how much you can contribute from each paycheck.

- Consider an auto-escalator on your contribution – most people won’t feel an impact to their paycheck if they automatically increase their contribution by 1% each year.

Individual Retirement Account (IRA)

An Individual Retirement Account (IRA) is available to anyone with earned income. It is a favorable option if you don’t have access to a 401(k) through an employer, or if you are reaching the annual 401(k) limits and want to continue retirement savings.

Like a 401(k), IRAs comes in both traditional and Roth options.

- Traditional IRA – Pre-tax contributions | Withdrawals taxed in retirement

- Roth IRA – After-tax contributions | Tax-free withdrawals in retirement

They also have annual contribution limits and eligibility rules to be aware of.

Where do you open an IRA?

Whereas a 401(k) is set up through your employer, IRAs are available through the financial institution of your choice. Banks and brokerage firms will offer different options.

At Fortifi Bank, your IRA deposits are automatically insured by the FDIC. That means your contributions cannot be lost because they are backed by the U.S. government.

On the other hand, IRA funds invested through a brokerage will gain or lose value depending on the state of the stock market.

DO THIS:

- Research and talk with a trusted financial advisor about what IRA may be right for you.

- After opening an account, review the annual contribution limits and your budget to determine how much, and how often, you’ll contribute.

Step 2. Monitoring Your Retirement Progress

Somewhere between “set it and forget it” and obsessively checking the market is a happy medium when monitoring your retirement savings progress.

Account Dashboard

No matter what account you choose, you should have access to an online view of your balance and contributions. Depending on the provider and type of account, you may have options to change allocations, increase contributions, and even see if you’re on track to retire by your target age.

It will be helpful to familiarize yourself with these tools and know how to access them when it’s time to check-in or make changes.

DO THIS:

- Ensure you have access to review your retirement account(s).

- Schedule a recurring time, such as bi-annually or annually, to log in and see how everything looks.

- Consider increasing your contributions to coincide with a raise or new year.

Professional Guidance

It’s nice having your account at your fingertips, but that doesn’t mean you’ll know everything about your options and best practices for success. That’s where a trusted financial partner comes in.

As you go through life changes like a new job, marriage, and buying a home, a financial planner will offer guidance and give you confidence you are making the correct changes to keep your plans on track.

DO THIS:

- Consider enlisting the help of a financial planner.

Step 3. Letting Time Work its Magic

You’ve reached the simplest yet slowest step. Sit back and wait.

Progress will feel painstakingly slow at first. You’ll wonder how it’s possible your future self will live comfortably from these small, regular contributions.

Compound Interest

The reason, of course, is compound interest. Compound interest is the interest you earn on both your original money and on the interest you keep accumulating. It’s how you can earn much more than you ever put in.

As an example, investing $100 over 35 years, never adding another penny to it, will net you approximately $1,479.

Investing that same $100 just 10 years sooner will increase the amount to $3,192.

Here is the change in just $100, assuming you never add more and interest is earned at an 8%* average:

- If I invest $100 at 20 years old, it will be worth $3,192 when I retire at 65.

- If I invest $100 at 25 years old, it will be worth $2,172 when I retire at 65.

- If I invest $100 at 30 years old, it will be worth $1,479 when I retire at 65.

- If I invest $100 at 35 years old, it will be worth $1,006 when I retire at 65.

- If I invest $100 at 40 years old, it will be worth $684 when I retire at 65.

Watch the magic of compound interest at work estimating your own numbers with Investor.gov’s Compound Interest Calculator.

Staying the Course

Once you start to see your retirement savings grow, it’s important to let it be. All your hard work, sacrifice, and tax benefits will be lost if you decide you need that money for something else before reaching retirement age. Instead, create a separate emergency fund to help in times of need.

Since your vision is long, you’ll inevitably encounter drastic gains and losses in the market. Stay calm and know that things will level out and your money will continue to grow year after year. If you’re truly worried about how your funds will be impacted, it’s another great time to check in with your financial planner.

This article is for educational purposes only. It is best to consult a tax advisor to help you understand tax advantages of each account and what is best for your situation.

*8% is a sample return. The average stock market return was about 10% per year for nearly the last 100 years. The S&P 500 is often considered the benchmark measure for annual stock market returns. However, stock market returns vary greatly. Unlike bank deposits, money in the stock market is not insured by the Federal Deposit Insurance Corporation (FDIC).

Ready to get in touch with a financial planner?

Simply fill out this form and we’ll get back to you soon.